The digital age has brought convenience and innovation, but it has also opened the floodgates to vulnerabilities that can have serious repercussions. As we step into 2024, the world is witnessing a surge in cybercrime, especially on social media platforms like Twitter. One alarming trend that has emerged is the alarming distribution of leaked credit cards on Twitter, posing significant risks to both individuals and businesses alike. This article seeks to explore the circumstances surrounding these leaks, the methods employed by cybercriminals, and the impact on victims.

With the increasing reliance on online transactions, credit card information has become a prime target for hackers and fraudsters. The leaked credit cards Twitter 2024 phenomenon is not merely a technical issue; it represents a pressing concern that affects the security and privacy of countless users. As we delve deeper into this issue, we aim to shed light on the motivations behind these leaks, the methods of operation, and the steps that can be taken to mitigate these risks.

Furthermore, as more individuals and organizations fall victim to credit card fraud, it is essential to understand the broader implications of these leaks on society. What does this mean for our trust in digital payment systems? How can individuals protect themselves in this evolving landscape? Join us as we unravel the complexities of the leaked credit cards Twitter 2024 situation, providing insights and guidance for navigating this treacherous digital terrain.

What Are the Reasons Behind the Leaked Credit Cards on Twitter in 2024?

The rise of leaked credit cards on Twitter can be attributed to several factors. Cybercriminals exploit vulnerabilities in various platforms to gain access to sensitive financial information. Here are some primary reasons:

- Increased Online Transactions: With the continued shift towards online shopping and digital payments, the volume of credit card information available online has skyrocketed.

- Weak Security Measures: Many individuals and businesses fail to implement robust security protocols, leaving their data exposed.

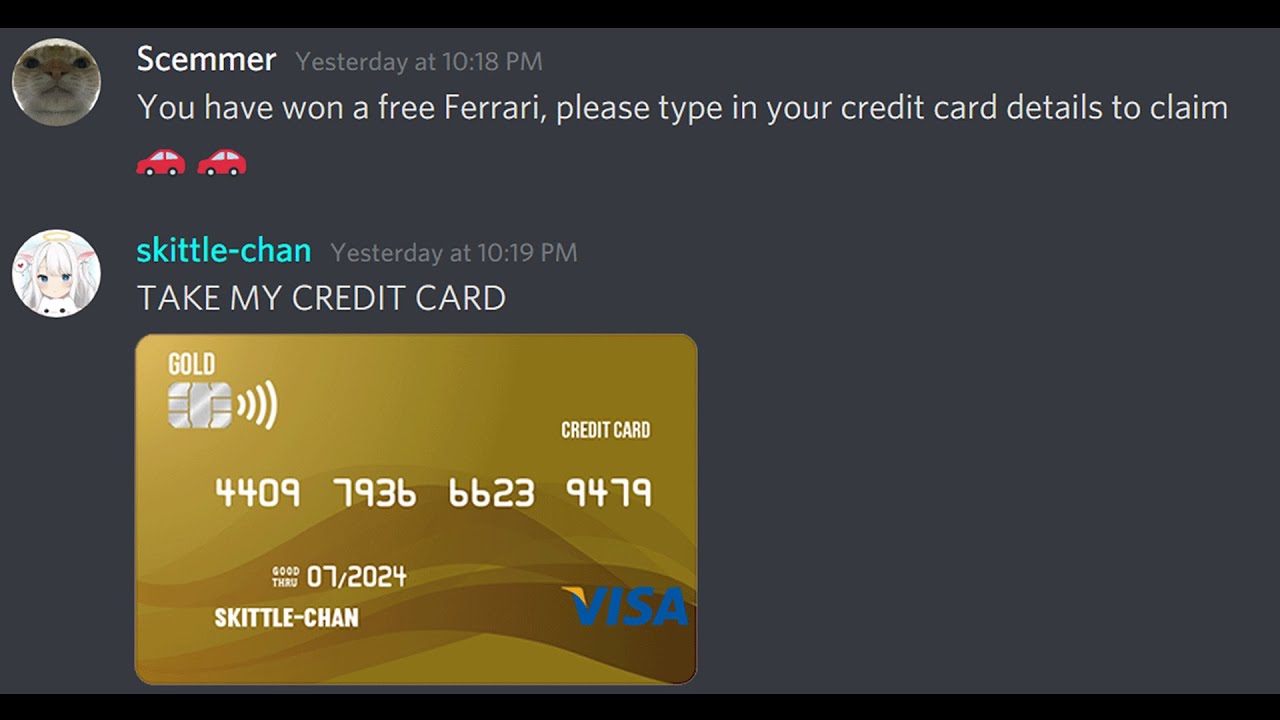

- Social Engineering: Cybercriminals often use social engineering tactics to manipulate victims into revealing their credit card information.

- Dark Web Marketplaces: Leaked credit card information is frequently sold on dark web forums, where it can be purchased for illicit use.

How Are Credit Cards Leaked on Twitter?

Understanding the methods employed by cybercriminals is crucial for prevention. Here are some common techniques:

- Phishing Attacks: Fraudsters send fake messages or emails that appear to be from legitimate sources to trick users into providing their credit card details.

- Data Breaches: Large-scale data breaches in companies can result in the exposure of millions of credit card numbers, which can then be disseminated on Twitter.

- Malware and Hacking: Cybercriminals can install malware on devices to capture keystrokes or access saved credit card information.

What Are the Consequences of Leaked Credit Cards on Twitter?

The ramifications of leaked credit cards can be severe, affecting individuals, businesses, and the overall economy. Here are some notable consequences:

- Financial Loss: Victims may face unauthorized charges, leading to significant financial loss.

- Identity Theft: Leaked information can lead to identity theft, resulting in long-term credit damage.

- Loss of Trust: Continued leaks can erode public trust in digital payment systems.

- Legal Implications: Companies may face legal actions if they fail to protect user data adequately.

Who Are the Victims of Leaked Credit Cards on Twitter?

The victims of leaked credit cards extend beyond individual users. Various groups can be affected:

- Consumers: Everyday individuals who unknowingly have their credit card information compromised.

- Businesses: Companies that suffer reputational damage and financial losses due to fraud.

- Financial Institutions: Banks and credit card companies that must deal with fraudulent transactions and customer disputes.

- Law Enforcement: Agencies tasked with investigating and prosecuting cybercrime cases.

How Can Individuals Protect Themselves from Leaked Credit Cards on Twitter?

Taking proactive measures can significantly reduce the risk of falling victim to leaked credit cards. Here are some steps individuals can take:

- Use Strong Passwords: Create complex passwords and change them regularly.

- Enable Two-Factor Authentication: Adding an extra layer of security can help protect accounts.

- Monitor Bank Statements: Regularly checking bank statements for unauthorized transactions can help catch fraud early.

- Be Wary of Phishing Attempts: Always verify the source of communication before providing personal information.

What Are Companies Doing to Combat Leaked Credit Cards on Twitter?

In light of the growing threat, companies are implementing various strategies to combat leaked credit cards:

- Investing in Cybersecurity: Companies are enhancing their cybersecurity measures to protect customer data.

- Data Encryption: Encrypting sensitive information makes it more difficult for cybercriminals to access it.

- Regular Security Audits: Conducting security audits can help identify and address vulnerabilities.

- User Education: Providing resources and training for users on recognizing and avoiding scams.

What Role Does Twitter Play in the Distribution of Leaked Credit Cards?

Twitter's role in the distribution of leaked credit cards is significant. The platform serves as a marketplace where stolen information can be shared and sold. Here are some aspects to consider:

- Ease of Sharing: The platform's nature allows for rapid dissemination of information.

- Anonymity: Users can operate anonymously, making it challenging to track down perpetrators.

- Community Discussions: Forums and discussions on Twitter can provide insights into the latest scams and techniques used by fraudsters.

What Should Victims Do If Their Credit Card Information Is Leaked?

If someone suspects that their credit card information has been leaked, immediate action is crucial. Here are the recommended steps:

- Contact Financial Institution: Inform the bank or credit card company about the suspected fraud.

- Freeze Accounts: Temporarily freezing accounts can prevent further unauthorized transactions.

- Monitor Credit Report: Regularly check credit reports for unfamiliar activity.

- Report to Authorities: File a report with local law enforcement and the Federal Trade Commission (FTC).

What Is the Future Outlook for Leaked Credit Cards on Twitter?

As technology continues to evolve, so too do the methods employed by cybercriminals. The future of leaked credit cards on Twitter appears bleak, with the potential for increasingly sophisticated tactics. However, with heightened awareness and improved security measures, there is hope for reducing the impact of these leaks.

In conclusion, the phenomenon of leaked credit cards on Twitter in 2024 is a pressing issue that requires vigilance and proactive measures from all users. By understanding the risks and taking necessary precautions, individuals and businesses can protect themselves from the devastating consequences of credit card fraud.

You Might Also Like

Exploring The Top 10 Worst Prisons In PennsylvaniaUnveiling The Charm Of The Rock Paper Scissors Shoot Yellow Dress Video

Unlocking The Secrets: How To Get Ronin Shell In Destiny 2

Behind The Scenes Of Osimhen's Life: The Role Of His Wife

Unveiling The Life Of Miranda Blakeslee: A Journey Through Passion And Resilience

Article Recommendations

- Demi Moore And Diddy

- Legendary Actress Lorraine Bracco Exploring Her Career And Impact

- Randy Adams Face Accident